Fireblocks, the heavyweight of institutional infrastructure, just expanded its DeFi reach.

How? By integrating the Canton Network. It’s a clear signal: the landscape for cross-chain interoperability is growing. By adding support for Canton, Fireblocks isn’t just adding a feature; they’re effectively lowering the drawbridge for asset managers and hedge funds to access fragmented liquidity across different blockchains without risking security.

Frankly, this integration matters less for the technical plumbing than for the shift it represents. Institutions are done letting assets gather dust in cold storage; they want the rails to deploy capital efficiently across decentralized finance protocols. The Canton Network integration delivers exactly that, a secure corridor for high-value transfers that cuts through the friction of traditional bridging.

Yet, while Fireblocks solves custody and transfers for institutions, a bigger shift is happening at the execution layer of the market’s largest asset. As liquidity rails improve, the bottleneck moves to the base layers themselves. This creates urgency around Bitcoin, the deepest capital pool but the hardest to program.

Against this backdrop, Bitcoin Hyper ($HYPER) has emerged as a focal point for investors, crossing a massive financial milestone as the market hunts for a solution to Bitcoin’s inherent sluggishness.

Bringing Solana Speeds to Bitcoin’s Base Layer

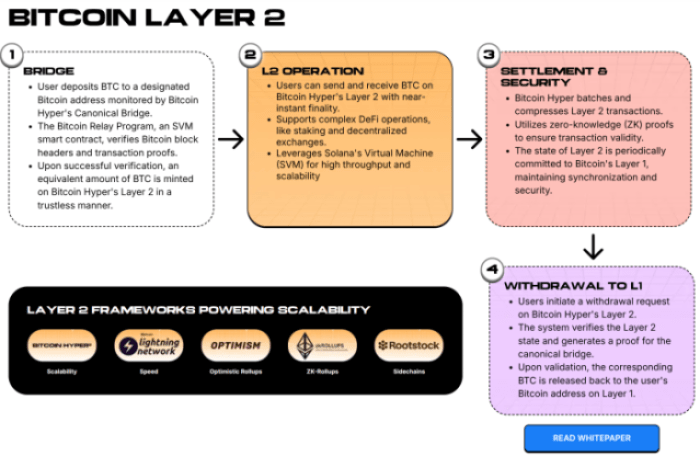

The market’s appetite for Bitcoin Layer 2 solutions has evolved from experimental curiosity to a demand for raw performance. Bitcoin Hyper ($HYPER) distinguishes itself in this crowded sector by doing something different: integrating the Solana Virtual Machine (SVM) directly into a Bitcoin Layer 2 framework. This architectural choice tackles the age-old ‘trilemma’ head-on: how do you introduce smart contract programmability without sacrificing the settlement security of the Bitcoin mainnet?

By using a modular blockchain structure, the project delegates settlement to Bitcoin L1 while handling execution on a real-time SVM Layer 2. The result? Sub-second finality and transaction costs under a cent, metrics typically associated with Solana, are now applied to the Bitcoin ecosystem. For developers, this opens the door to building complex DeFi applications, NFT platforms, and gaming dApps using Rust, all while leveraging Bitcoin’s liquidity.

This matters. Most Bitcoin L2s rely on the Ethereum Virtual Machine (EVM), which, while popular, often struggles with the throughput required for high-frequency trading. The SVM integration suggests a strategic pivot toward speed. The protocol employs a single trusted sequencer with periodic L1 state anchoring. That means while execution is rapid, the ultimate truth of the ledger stays secured by Bitcoin’s proof-of-work.

FIND OUT MORE ABOUT $HYPER IN OUR ‘WHAT IS BITCOIN HYPER?’ GUIDE.

Strategic Market Positioning and Liquidity Milestones

The momentum behind high-performance Bitcoin scaling is becoming impossible to ignore as capital gravitates toward the most efficient execution layers.

While institutional giants focus on the ‘plumbing,’ the market is voting with its feet on where the actual value will reside. Bitcoin Hyper ($HYPER) has demonstrated exceptional strength by surpassing $31.2M in its ongoing presale, a milestone that underscores the flight to quality in a crowded L2 market.

This liquidity surge is bolstered by a deflationary tokenomic structure and a governance-first staking model. With a total supply capped at 21B, aligning perfectly with Bitcoin’s core scarcity, the protocol is designed to capture and hold long-term value. Investors are particularly focused on the post-launch staking rewards, which aim to provide high APY to early supporters, incentivizing a stable, committed community over short-term ‘pump and dump’ cycles.

As the industry transitions from simple storage to high-speed asset deployment, $HYPER is positioning itself as the primary engine for the next generation of Bitcoin utility.

BUY BITCOIN HYPER ($HYPER) NOW.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrencies, including presale tokens, are volatile and high-risk assets. Always perform your own due diligence before investing.